US Trade Deficit

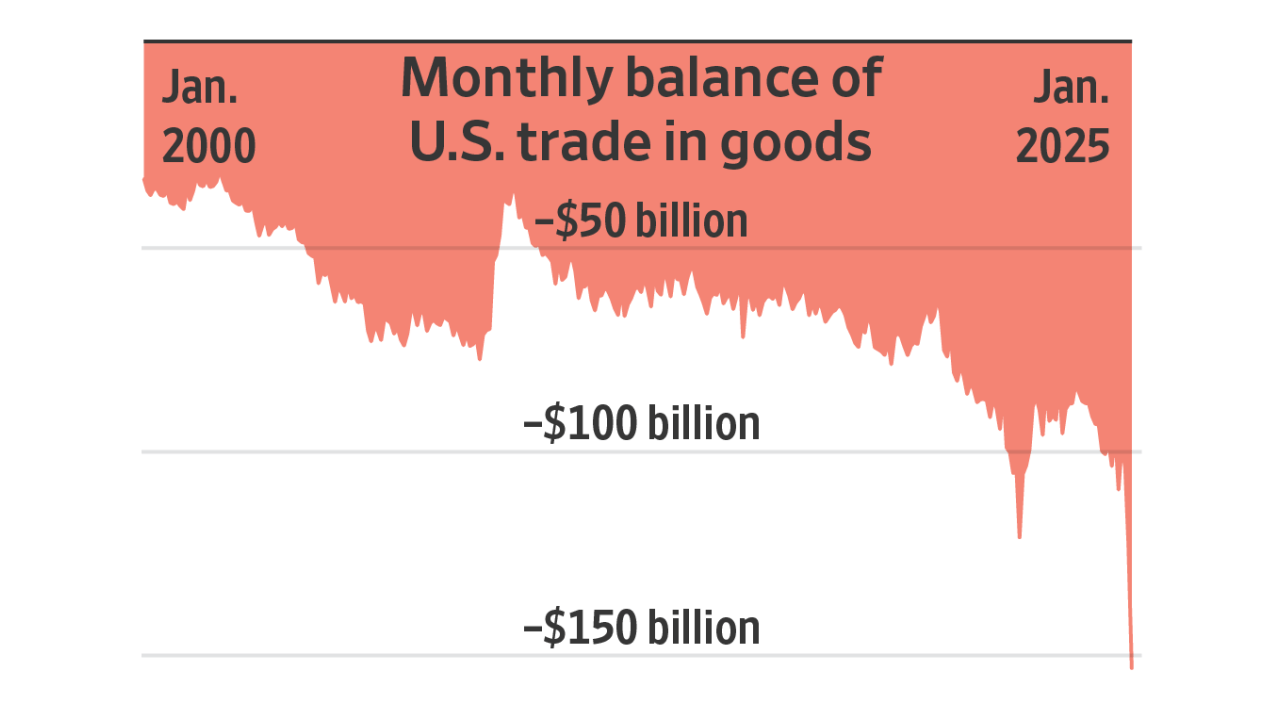

Recently, the United States continues to grapple with trade deficit. In 2024, the trade deficit exceeded $1 trillion for the fourth consecutive year. The persistent imbalance indicates a reliance on imported goods over domestic manufacturing. This situation has sparked debates regarding strategies to boost US manufacturing and address trade deficits.

What is Trade Deficit?

A trade deficit occurs when a country imports more goods than it exports. The US has faced trade deficits for decades, which raises concerns about manufacturing capabilities and job creation. Despite low unemployment rates, the focus remains on increasing domestic production and reducing reliance on foreign imports.

The Role of the US Dollar

The strength of the US dollar influences trade patterns. A strong dollar enhances purchasing power, making imports cheaper. This phenomenon encourages consumers to buy foreign products. The trust in the dollar as a stable currency encourages its widespread use in global transactions, with 60% of foreign exchange reserves held in dollars.

Strategies to Address Trade Imbalance

Two primary strategies have emerged to tackle the trade deficit. The first involves imposing tariffs on imports. This approach aims to make foreign goods more expensive, thereby encouraging domestic production. However, tariffs can lead to retaliatory measures from other countries, escalating into trade wars and increasing costs for consumers. The second strategy focuses on devaluing the dollar. A weaker dollar would make US exports more competitive internationally. This could be achieved through coordinated efforts with other nations to adjust currency values. The Plaza Accord of 1985 serves as a historical example of such a collaboration.

The Plaza Accord

The Plaza Accord was agreement among the G-5 nations to depreciate the US dollar. This agreement aimed to enhance trade balance by making US exports more attractive. While it temporarily alleviated trade deficits, it also led to economic challenges for some partner countries, notably Japan, which struggled with currency appreciation and subsequent economic stagnation.

The Challenges of a New Accord

The possibility of a new agreement, such as the Mar-a-Lago Accord, faces numerous obstacles. The global economic landscape is more complex now, with more countries involved and shifting alliances. The scale of required currency adjustments is vast, and convincing nations to compromise their economic interests poses challenges.

Current Economic Landscape

The current economic environment is marked by heightened competition, particularly from China. The geopolitical implications complicate negotiations, as US trade partners may be reluctant to engage in agreements that could harm their economies. Additionally, the sheer volume of currency transactions dwarfs those of previous decades, making coordinated interventions more challenging.

Month: Current Affairs - March, 2025

Category: Economy & Banking Current Affairs