UBS

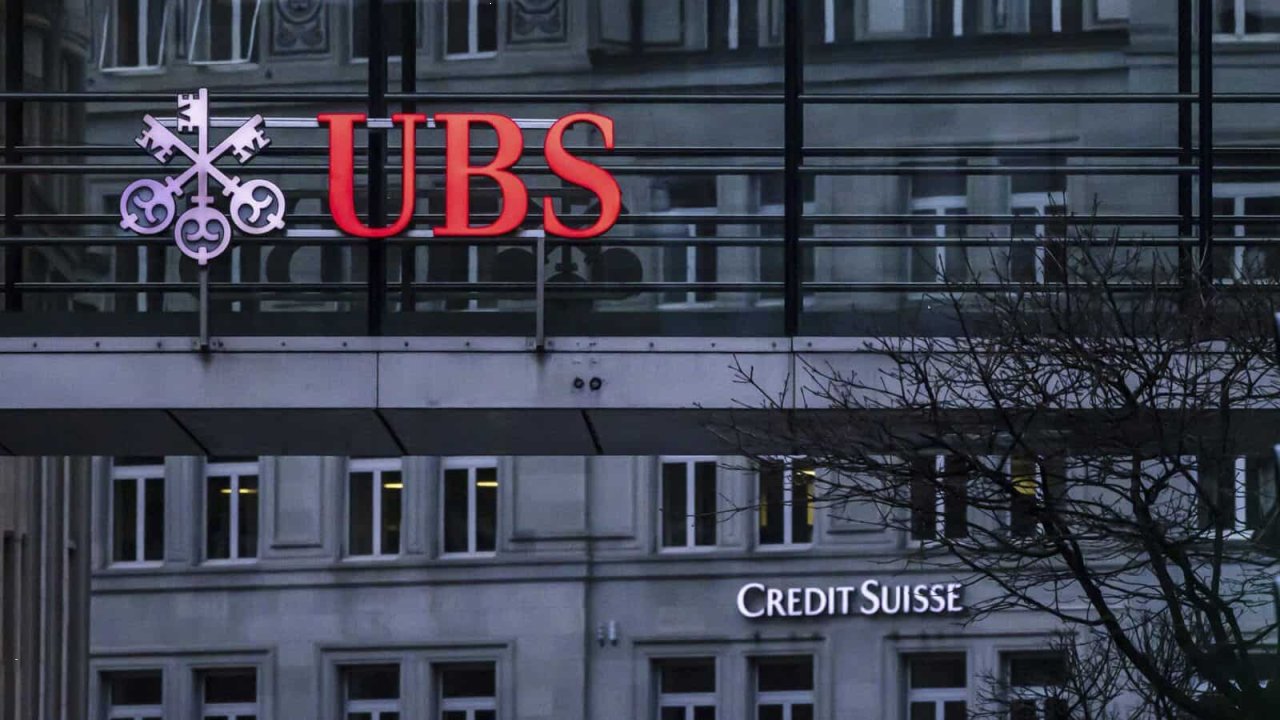

UBS, Switzerland’s biggest bank, recently agreed to purchase Credit Suisse in a move that aims to contain the panic that ensued after two American banks collapsed earlier this month. This unique acquisition has sent shockwaves throughout the banking industry and has garnered attention from investors and analysts worldwide. In this article, we delve into the history of UBS and analyze the impact of this deal on the global banking sector.

History of UBS Bank

UBS was established in 1998 when the Swiss Bank Corporation and the Union Bank of Switzerland merged together. The Swiss Bank Corporation was founded in 1854 as the Basel Bank Corporation by six private bankers in Basel, Switzerland. It merged with the Zürich Bank Corporation and entered the commercial banking sector. In 1897, the bank changed its name to Swiss Bank Corporation and acquired several other banks in Switzerland and abroad. The Union Bank of Switzerland opened in 1912 after the merger of Bank in Winterthur and Toggenburger Bank. Like the Swiss Bank Corporation, it also acquired several banks in Switzerland and became one of the country’s biggest banks.

UBS Today

UBS is now one of the largest banks in the world, with a market capitalization of $63 billion as per a 2022 report. It has around 200 branches and 4,600 client advisors in Switzerland alone, and provides its services in 50 other countries, including India. UBS is known for providing private banking, wealth management, asset management, and investment banking services for private, corporate, and institutional clients.

Impact of the Acquisition

The acquisition of Credit Suisse by UBS created a major impact in the banking industry. The Swiss government and regulators brokered the deal, with UBS paying around $3.2 billion to Credit Suisse and the Swiss central bank providing $108 billion in liquidity assistance to both banks. The Swiss government also agreed to provide more than $9 billion to backstop some losses that UBS may incur by taking over Credit Suisse. While this deal aims to contain the global financial market panic, the impact of this acquisition on the global banking sector is yet to be seen.

Month: Current Affairs - March, 2023

Category: Economy & Banking Current Affairs