Recommendations of Task Force on Simplification of Direct Tax

The task force on simplification of direct tax legislation headed by Central Board of Direct Taxation (CBDT) member Akhilesh Ranjan has recommended major changes in personal income tax slabs.

Recommendations of the Task Force

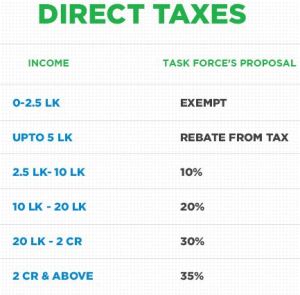

- Continuation of the minimum exemption limit of Rs 2.5 lakh per annum.

- Continuing the tax rebate announced in the interim budget for those with an income of up to Rs 5 lakh per annum.

- The task force has recommended increasing the slabs from four to five.

- Replacing the decades-old Income Tax Act for simplifying income tax provisions and improving tax certainty.

- Doing away with dividend distribution tax and minimum alternate tax.

- To reduce litigation the committee has recommended the government to discourage surcharges as the task force is of a view that if levied, surcharges should be temporary in nature.

The government has not yet accepted the proposals of the task force and the Finance Ministry is deliberating on the report before making it public. If the proposals are accepted then people can save up to Rs 1.5 lakh per annum in their tax outgo.

The recommendations are based on the studies conducted on the sensitivity of consumer spending to changes in tax rates indicate that marginal propensity to consume could increase significantly with the reduction in tax rates, particularly in the middle-income group.

Originally written on

August 31, 2019

and last modified on

November 17, 2019.

Tags: Income Tax Act, Income tax in India, Tax, Taxation in India