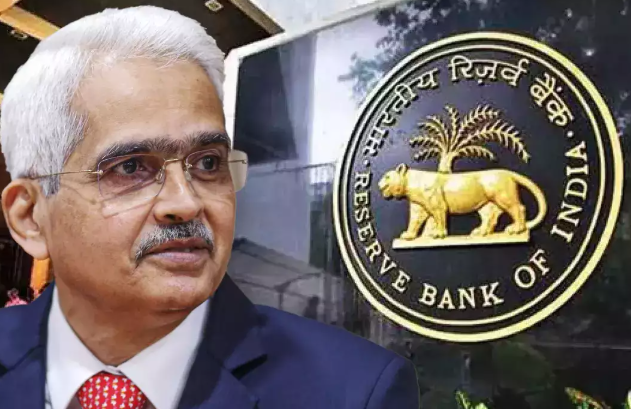

RBI Launches Podcast Series for Public Communication

The Reserve Bank of India (RBI) Governor Shaktikanta Das announced a new podcast series to enhance public communication. This initiative aims to improve financial literacy and will provide clear vital information about monetary policy.

Key Interest Rate and CRR Decisions

The RBI has maintained its key interest rate, and addresses ongoing inflation concerns. Additionally, the Cash Reserve Ratio (CRR) has been reduced. This reduction aims to inject liquidity into the economy. The goal is to support banking growth and economic stability.

Educational Initiatives in Various Languages

Governor Das emphasized the importance of financial education. The RBI recently released booklets in Santali (Ol Chik), which explain financial products and digital banking. They target children, farmers, entrepreneurs, and senior citizens. Such resources promote better understanding in rural areas.

AI and Financial Sector Innovations

The RBI is exploring artificial intelligence (AI) applications. A new committee, FREE-AI, is being established. This committee will manage AI-related risks in finance. It aims to ensure responsible and ethical AI use. The RBI seeks to strengthen the financial system through technology.

Focus on Rural and Underserved Areas

Improving financial literacy remains a priority for the RBI. Special attention is given to rural and underserved communities. Resources are being developed in multiple languages. This approach helps bridge the knowledge gap in finance.

The RBI is investigating advanced technologies like machine learning. These technologies aim to combat digital fraud. Strengthening the financial system is crucial in ‘s digital age. The RBI is committed to tackling these challenges effectively.

GKToday Facts for Exams:

- Santali (Ol Chik): Santali is a language spoken by the Santal people in India. It belongs to the Austroasiatic language family. The RBI’s booklets aim to promote financial literacy among Santali speakers.

- FREE-AI: FREE-AI stands for Framework for Responsible and Ethical Enablement of AI. It is a committee set up by the RBI. The committee focuses on managing AI-related risks in the financial sector.

- Cash Reserve Ratio (CRR): CRR is the percentage of a bank’s total deposits that must be held in reserve with the central bank. It is a tool used to control liquidity and inflation in the economy.

- Monetary Policy: Monetary policy refers to the actions taken by a central bank to manage the money supply and interest rates. It aims to achieve macroeconomic objectives like controlling inflation and stabilising currency.

Month: Current Affairs - December, 2024

Category: Economy & Banking Current Affairs