1. While capital requirements in Small Finance Banks has been kept at Rs. 500 Crore, it has been kept Rs. 100 Crore for Payment banks

2. While payment banks are to provide payment solutions, Small Finance Banks are to boost saving habits among lowest strata of the society

Select the correct option from the codes given below:

Answer: Only 2

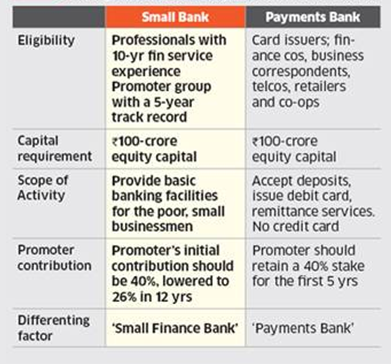

Notes: Comparison of Payment Banks and Small Finance Banks While payment banks are to provide payment solutions, Small Finance Banks are to provide basic banking services for the purpose of financial inclusion and boosting saving habits among lowest strata of the society. While Car issuers, finance companies, Business Correspondents, Telcos, retailers and Cooperatives are eligible to apply for Payment banks; professionals with 10 years experience in finance are eligible to apply for small finance banks. The Capital requirement for both the types of banks is Rs. 100 Crore. However, In case of small finance banks, the Minimum initial contribution of the promoter to the paid-up capital is fixed at 40% and they can bring down his holding to 26% in 12 years from commencement. In Payment banks, the promoters should retain 40% stake for the first five years.