Indian Economy

Difference between Inflation, Deflation and Disinflation

Inflation refers to rise in general price level of goods and services, deflation is fall in general price level of goods and services. Deflation is inflation in negative zone, i.e. a decrease in the general price level of goods and ..

Measurement of Inflation in India

There are several ways to measure inflation. On the basis of population coverage, the inflation indices are developed to understand the levels of inflation for certain sets of population such as consumers, producers, retailers, wholesalers etc. Such indices are called ..

Inflation: Definition, Types, Impacts and Control

Inflation is a rise in the general level of prices of goods and services in an economy over a period of time. When the general price level rises, Each unit of currency buys fewer goods and services. This implies that: ..

Concept of Aggregate Demand

When we combine the monetary value of all the final goods and services, it is called Gross Domestic Product or GDP. The demand for all such final goods and services is called aggregate demand. On the same note, supply of ..

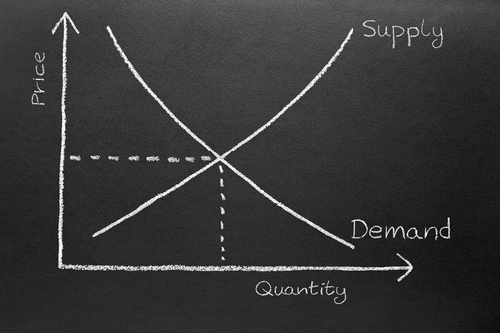

Concepts of Demand & Supply in Economics

Demand is the quantity of goods and services that consumers are willing and able to purchase at various prices during a particular period of time. There are five elements of Demand: Desire or want for a commodity or service Means ..

Poverty in India: Causes and Measures to Alleviate Poverty

Various causes of poverty are listed below: Rapid growth of population Population explosion is the single most factors responsible for high level of poverty in India. This rise is mainly due to fall in death rate and more birth rate. ..

Gulshan Rai Committee on Cybersecurity

A committee under Gulshan Rai, National Cyber Security Coordinator was constituted by the NDA Government in December 2014. It has recently submitted its report on “Roadmap for Effectively Tackling Cyber Crimes in the Country” to Home Ministry. This committee has ..

Types of Non-Banking Financial Companies (NFBC)

All NBFCs are either deposit taking or Non-deposit taking. If they are non-deposit taking, ND is suffixed to their name (NBFC-ND). The NBFCs which have asset size of Rs.100 Crore or more are known as Systematically Important NBFC. They have ..

Priority Sector Lending

In the first week of September, 2020, the Reserve Bank of India has revised the Priority Sector Lending norms. As per the new guidelines, loans up to Rs. 50 Crore for startups in agriculture and MSME sector would be given ..

Gross Domestic Product

Understanding the Concept of GDP The money value of all the final goods and services produced in the domestic territory of a country in a year’s time is called the Gross Domestic Product. The domestic territory includes the political boundary ..