Geopolitical Risks and Their Economic Impacts

Recent global tensions have heightened geopolitical risks, impacting economic and financial stability worldwide. Events such as wars, diplomatic conflicts, and terrorism can disrupt trade and investment. These disruptions can lead to declines in asset prices and curtail lending, which ultimately weighs on economic activity. Investors find it challenging to price these risks due to their unpredictable nature. The latest Global Financial Stability Report marks that stock prices often drop during major geopolitical events, particularly in emerging markets.

Types of Geopolitical Risks

Geopolitical risks include military conflicts, diplomatic tensions, and terrorism. Each type can have varying impacts on economies. Military conflicts are particularly damaging, leading to sharp declines in stock prices and increased sovereign risk premiums. The effects are more pronounced in emerging markets due to their economic vulnerabilities.

Impact on Stock Markets

Stock markets react negatively to geopolitical shocks. On average, global indices decline by about 1% following events. However, emerging markets experience a sharper drop, averaging 2.5%. In cases involving military conflict, the decline can reach 5%. This volatility is often due to decreased investor confidence and increased uncertainty.

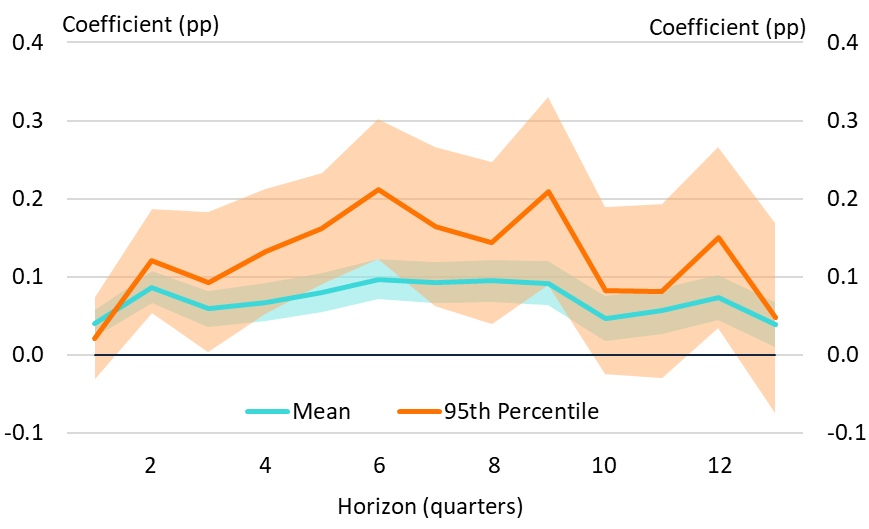

Sovereign Risk Premiums

Geopolitical risks lead to higher borrowing costs for governments. Sovereign credit default swaps rise, indicating increased risk of default. Advanced economies see an average increase of 30 basis points, while emerging markets may experience a rise of up to 180 basis points in military conflict scenarios. This increase reflects concerns over fiscal stability amid rising government spending.

Cross-Border Spillovers

Geopolitical events can affect economies beyond the immediate conflict zone. Countries that share trade links with nations involved in conflicts often see their stock prices decline as well. On average, these firms experience a 2.5% drop in stock valuations following such events.

Financial Stability and Lending

Geopolitical shocks create uncertainty that can ripple through the financial system. Banks may reduce lending due to increased risk. Investment funds may face lower returns and elevated redemption risks. This can lead to a cycle of reduced investment and economic slowdown.

Mitigation Strategies

Despite the unpredictability of geopolitical risks, financial institutions can take steps to safeguard stability. This includes conducting stress tests and maintaining sufficient capital and liquidity. Emerging markets should focus on strengthening financial systems and building fiscal buffers to withstand shocks.

Investor Awareness

Investors must remain vigilant regarding geopolitical risks. While not every event will lead to a crisis, ignoring these risks could result in financial losses.

Month: Current Affairs - April, 2025

Category: Economy & Banking Current Affairs