54th GST Council Meeting

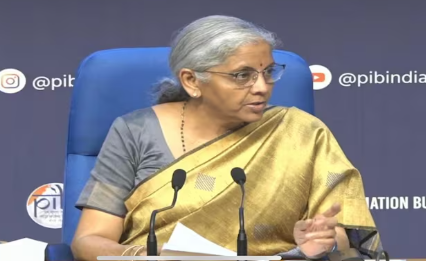

The 54th Goods and Services Tax (GST) Council meeting took place in New Delhi, led by Finance Minister Nirmala Sitharaman. The council focused on adjusting tax rates for essential items, including health insurance, cancer drugs, and snacks.

Major Decisions Made

Group of Ministers (GoM): A special group has been created to review GST rates on health insurance, cancer medicines, and savoury snacks (known as namkeens).

GST Cut on Cancer Drugs: The council proposed reducing the GST from 12% to 5% on specific cancer treatments. This includes expensive drugs like Trastuzumab Deruxtecan, Osimertinib, and Durvalumab.

Impact on Cancer Treatment

The reduction in GST is expected to lower the cost of cancer treatments, which can be very high. India has seen a rise in cancer cases, and this move aims to help reduce the financial stress on patients. Below are some of the current prices of key cancer drugs:

- Trastuzumab Deruxtecan: ₹22,300 per vial

- Osimertinib: ₹204,000 for 10 tablets

- Durvalumab: ₹157,000 per vial

Potential Reductions on Other Goods

Savoury Snacks (Namkeens): The council is considering reducing GST on these snacks from 18% to 12%, with non-fried variants possibly taxed at 5%.

Research Services: Services provided by government bodies, universities, and colleges for research could be exempt from GST.

Increases in GST for Certain Items

Car and Motorcycle Seats: The GST on these items may increase from 18% to 28%.

Helicopter Charters: GST for helicopter charters will stay at 18%, but passenger transport via helicopters will continue to be taxed at 5%.

Changes in Taxpayer Responsibilities

Reverse Charge Mechanism: Updates have been proposed for how taxes are applied on commercial property rentals and metal scrap transactions. In certain cases, the buyer will be responsible for paying the tax.

Interest Waiver: Taxpayers who have pending tax demands from previous years may be eligible for a waiver if they pay by March 31, 2025.

Future Plans

GoM Report on Insurance: The GoM will submit its findings on life and health insurance GST rates by October 2024.

New Invoice System: A new Invoice Management System (IMS) will be introduced to simplify invoicing and reduce errors in input tax credits. A pilot project for B2C (business-to-consumer) e-invoicing will also be launched to improve retail transaction transparency.

This meeting reflects important changes in India’s GST policy. By lowering taxes on key cancer drugs and other essentials, the council aims to ease the financial burden on consumers. However, certain goods and services like car seats may see higher taxes, balancing out the tax reliefs in other areas.

Month: Current Affairs - September, 2024

Category: Economy & Banking Current Affairs